Opportunity Zones

Opportunity Zones are economically distressed communities, defined by individual census tract, nominated by America’s governors, and certified by the U.S. Secretary of the Treasury via his delegation of that authority to the Internal Revenue Service. Under certain conditions, new investments in Opportunity Zones may be eligible for preferential tax treatment. There are 8,764 Opportunity Zones in the United States, many of which have experienced a lack of investment for decades. The Opportunity Zones initiative is not a top-down government program from Washington but an incentive to spur private and public investment in America’s underserved communities.

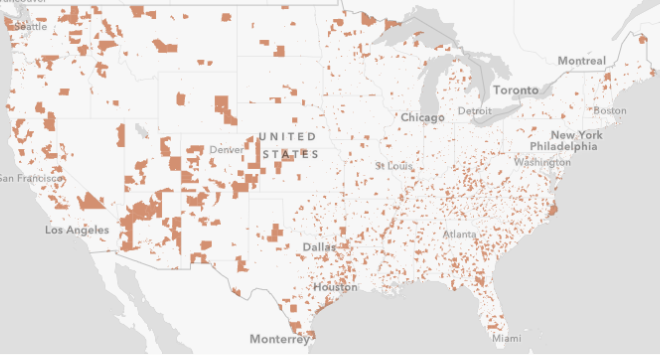

MapsDesignated Opportunity Zones in the U.S. by Esri Japan, METI, Esri China (Hong Kong), and the GIS User Community

Origins of OpportunityZones

Originally introduced in the Investing in Opportunity Act (IIOA), the Opportunity Zones Program was enacted as part of the 2017 tax reform package (Tax Cuts and Jobs Act). The program is designed to drive long-term capital to rural and low-income urban communities throughout the nation, and uses tax incentives to encourage private investment in impact funds.

The Opportunity Zones Program has been introduced as an innovative approach to unlocking long-term private investment to support low-income urban and rural communities in every U.S. state and territory. Investors are eligible to receive certain tax benefits on unrealized capital gains reinvested in Opportunity Zones through pooled Opportunity Funds. The program is designed to minimize cost and risk to the taxpayer. Investors bear the risk on all their originally deferred capital gains, minus a modest reduction for long-term holdings, regardless of whether subsequent investments have increased or decreased in value. Neither tax credits nor public-sector financing is involved.

Designated Opportunity Zones of Continental U.S. by EIGS

Opportunity Zones

The program uses low-income community census tracts as the basis for determining areas eligible for an Opportunity Zone designation.

- Low-income census tracts are places with an individual poverty rate of at least 20 percent and median family income no greater than 80 percent of the area median.

- A census tract that is not a low-income community may be designated as a qualified Opportunity Zone if the tract is contiguous with the low-income community designated as

- a qualified Opportunity Zone, and the median family income of the tract does not exceed 125 percent of the median family income of the low-income community contiguous with the tract. Up to 5 percent of the population census tracts designated as Opportunity Zones may qualify under this exemption.

- Per state/territory, up to 25 percent of the total number of census tracts that qualify as an Opportunity Zone can be designated as an Opportunity Zone.

According to the White House Opportunity and Revitalization Council:

- Nearly 35 million Americanslive in communities designated as Qualified Opportunity Zones;

- Unemployment rates are 1.6 times higher in Opportunity Zone census tracts than the average United States census tract;

- Median family incomes in Opportunity Zones are 37 percent lower than their respective area’s or State’s median;

- The average poverty rate across Opportunity Zones is more than 32 percent, almost double the rate of approximately 17 percent for the average United States census tract;

- One in four Opportunity Zones have a poverty rate over 40 percent, compared to one in 15 census tracts nationwide;

- The homeownership rate in Opportunity Zones is approximately 15 percentage points lower than the nationalaverage;

- Life expectancy is on average three years shorter for Opportunity Zone residents than it is nationally; and

- Approximately 22 percent of Opportunity Zone adult residents have not attained a high school diploma, compared to 13 percent nationally.

Opportunity Funds

Opportunity Funds are a new class of investment vehicles (organized as a corporation or a partnership) that specialize in aggregating private investment and deploying that capital in Opportunity Zones to support Opportunity Zone Property.

- A minimum of 90 percent of Opportunity Fund assets must be invested in Opportunity Zones.

- Opportunity Funds are envisioned as a market solution for investors who lack the information and wherewithal to execute investments in rural and low-income urban communities.

- The statute does not limit the number of funds that can be created, nor does it provide instruction on the nature of investments (i.e., risk/return profile).

- Pooling capital through a fund structure provides an opportunity for a broad array of investors throughout the country to engage in the program.

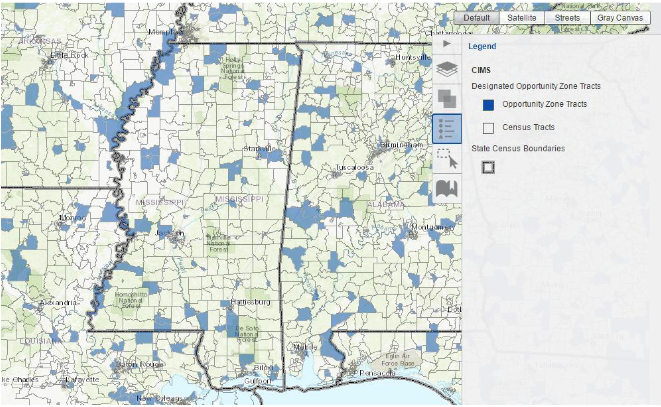

Designated Opportunity Zones Counties of the State of Mississippiby CIMS

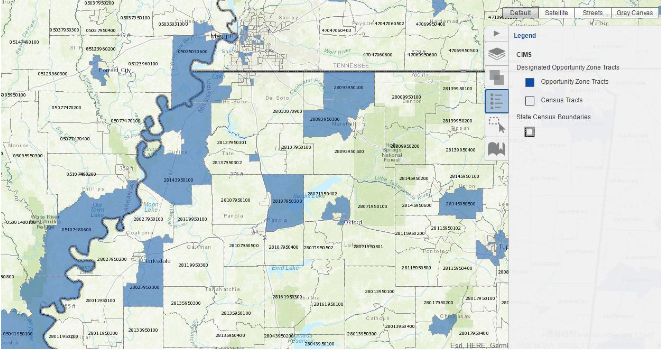

Designated Opportunity Zones Zoomed to North Delta Region by CIMS